When to Recalculate Your Emergency Fund

Know when to recalculate your emergency fund target. Life changes, inflation, and evolving expenses mean your safety net needs periodic review.

Read article →Insights and Updates

Learn more about FinancialAha, financial tracking, planning, concepts, implementation, usage, the vision behind FinancialAha, and more.

Know when to recalculate your emergency fund target. Life changes, inflation, and evolving expenses mean your safety net needs periodic review.

Read article →

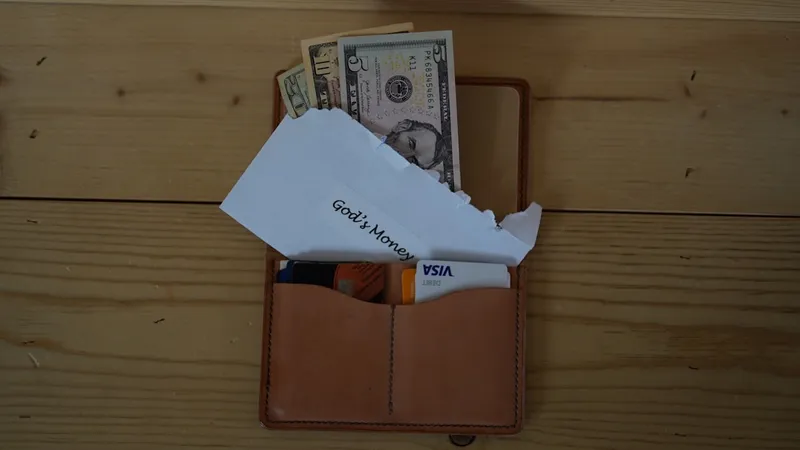

Learn envelope budgeting methods for the digital age. Explore cash stuffing, digital envelope systems, and app-free approaches to category-based spending limits.

Read article →

Learn how to create a budget based on biweekly paychecks. Align bills with pay periods and handle the two extra paychecks per year strategically.

Read article →Learn how to track investments in your net worth spreadsheet, including stocks, bonds, retirement accounts, and real estate for a complete wealth picture.

Read article →

Plan your wedding budget with realistic cost breakdowns, category allocations, and strategies for managing the financial side of your big day.

Read article →

Learn how multiple savings accounts or savings buckets can organize your finances, protect goals, and make tracking progress easier.

Read article →

Learn the pay yourself first budgeting method and how to automate savings before spending. Build wealth consistently without willpower or manual transfers.

Read article →

Stop paying for forgotten subscriptions. Learn how to track recurring expenses, identify unused services, and take control of subscription creep.

Read article →

Learn how sinking funds work and why saving for planned expenses prevents budget emergencies. Step-by-step guide to setting up your own sinking fund system.

Read article →

Calculate how extra mortgage payments affect your payoff date and interest savings. Compare strategies for paying off your home loan faster.

Read article →

Calculate your student loan payoff date and explore strategies to pay off loans faster. Compare standard repayment vs. accelerated approaches.

Read article →Build a savings goal tracker in Google Sheets to visualize progress toward financial goals. Includes templates, formulas, and progress bar techniques.

Read article →

Add dropdown lists to your budget spreadsheet for consistent category selection. Reduce errors and speed up data entry with this step-by-step guide.

Read article →

Protect your budget spreadsheet formulas by locking cells. Learn how to prevent accidental changes while keeping data entry areas editable.

Read article →Use conditional formatting to create visual alerts in your budget spreadsheet. Automatically highlight overspending, track progress, and spot problems instantly.

Read article →Download instantly and start managing your finances, or contact us to design a custom template package for your needs.